Table Of Content

Nonetheless, experts foresee an inevitable downward trend, though probably not in the immediate future. For those hoping to refinance, mortgage rates are not cooperating. Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesn’t process the loan before the rate lock expires, you’ll need to negotiate a lock extension or accept the current market rate at the time. However, the Federal Reserve has indicated it will begin cutting rates in 2024 as the economy cools and inflation continues to fall. Assuming these trends hold steady, you can expect to see lower mortgage rates in 2024.

How to choose the best mortgage lender for you

Investment property mortgage rates for April 2024 - CNN Underscored

Investment property mortgage rates for April 2024.

Posted: Tue, 20 Feb 2024 08:00:00 GMT [source]

Keep in mind that a mortgage’s interest rate is not the same as its annual percentage rate (APR). This is because an APR includes both the interest rate and any other lender fees or charges. If your details closely match those used to calculate today’s rates, possibly.

Mortgage rates just hit their highest since 2002 - NPR

Mortgage rates just hit their highest since 2002.

Posted: Thu, 17 Aug 2023 07:00:00 GMT [source]

Our services

Comparing rates and fees from several lenders is important, not only from traditional lenders such as local banks, but also Fintech lenders. Importantly, when comparing offers, homebuyers need to take into account other costs beyond principal and interest payments. Be careful not to confuse interest rates and APR — both are expressed as a percentage, but they’re very different. A typical interest rate accounts only for the fees you’re paying a lender for borrowing money. An APR, on the other hand, captures a broader view of the costs you’ll pay to take out a loan, including the interest rate plus closing costs and fees. The lengthy 30-year term allows you to spread out your payments over a long period of time, meaning you can keep your monthly payments lower and more manageable.

Consider different types of home loans

The Fed also considers employment readings and other economic data in its decision-making process. Answer some questions about your homebuying or refinancing needs to help us find the right lenders for you. It’s important to understand that buying points does not help you build equity in a property—you simply save money on interest. To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Learn more about how to refinance and compare today’s refinance rates to your current mortgage rate to see if refinancing is financially worthwhile. The best type of mortgage loan will depend on your financial goals — while some loan types consistently offer lower rates, they may do so at the expense of higher monthly payments or complicated repayment terms. Weigh the pros and cons of a 15- versus 30-year loan and take time to understand ARM rates and how they differ from traditional fixed mortgage rates before signing on the dotted line. When shopping around for mortgage rates, consider not only the interest rate, but also the other terms of the loan, like annual percentage rates (APRs), fees and closing costs. Comparing loan details from multiple lenders will help you determine the best deal for your situation. Lenders set the interest rates for their own loan products based on influence from the Federal Reserve, the economy and consumer demand.

The underwriter's job is to verify your mortgage application one more time with the documentation provided. The conditional approval means that your home closing can move forward as long as the listed conditions are met. Once everything is checked off the list, you’ll be clear to close and fully approved to purchase the home. The lowest-risk rate locks are fee free and have a float-down feature.

Mortgage

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

Conforming adjustable-rate mortgage (ARM) loans

We offer a wide range of loan options beyond the scope of this calculator, which is designed to provide results for the most popular loan scenarios. If you have flexible options, try lowering your purchase price, changing your down payment amount or entering a different ZIP code. After getting a mortgage, you’ll typically receive an amortization schedule, which shows your payment schedule over the life of the loan.

Compare today’s refinance rates

Limited housing inventory and low wage growth are also contributing to the affordability crisis and keeping mortgage demand down. Over the last few years, high inflation and the Federal Reserve’s aggressive interest rate hikes pushed up mortgage rates from their record lows around the pandemic. Since last summer, the Fed has consistently kept the federal funds rate at 5.25% to 5.5%. Though the central bank doesn’t directly set the rates for mortgages, a high federal funds rate makes borrowing more expensive, including for home loans. The rates and monthly payments shown are based on a loan amount of $940,000 and a down payment of at least 25%. The rates and monthly payments shown are based on a loan amount of $270,072 and no down payment.

Federal Reserve raises its interest rate target for overnight lending between banks, and interest rates throughout the financial sector typically follow suit. From March 2022 to July 2023, the Fed raised its policy rate 11 times, leading to a surge in mortgage rates. A change in demand for 10-year Treasury bonds and mortgage-backed securities also contributed to 2023’s higher rates. In addition to monetary policy, lenders also have an impact on mortgage rates. A lender with physical locations and a lot of overhead may charge higher interest rates to cover its operating costs and make a profit on its mortgage business. On the other hand, lenders that operate solely online, tend to offer lower mortgage rates because they have less fixed costs to cover.

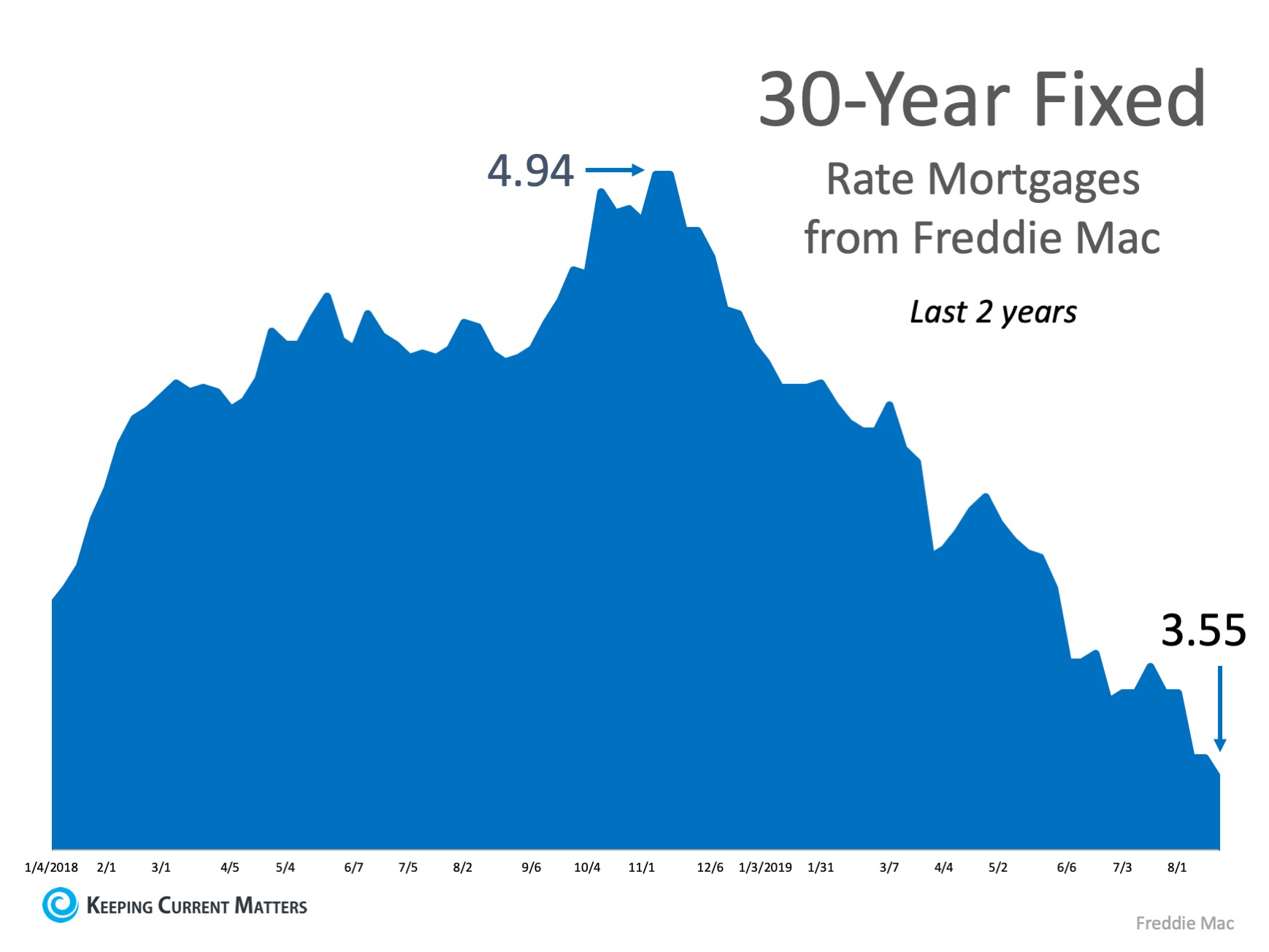

The 30-year fixed-rate mortgage is the most common type of home loan. With this type of mortgage, you'll pay back what you borrowed over 30 years, and your interest rate won't change for the life of the loan. The average 30-year fixed mortgage rate was 7.17% this week, according to Freddie Mac.

If the Federal Reserve raises or lowers the short-term rates to guide the economy, lenders may adjust their mortgage rates as well. Individual circumstances like credit score, down payment and income, as well as varying levels of risk and operational expenses for lenders, can also affect mortgage rates. Along with certain economic and personal factors, the lender you choose can also affect your mortgage rate. Some lenders have higher average mortgage rates than others, regardless of your credit or financial situation. When you shop for a mortgage, the lender will prepare a mortgage loan offer, which will detail the proposed loan rate, loan duration, and monthly payment amount if the loan is approved.

No comments:

Post a Comment